Workers’ Compensation Calculator

Estimate potential compensation benefits based on your wage, disability rating, and state guidelines.

Case Details

Estimate

Enter your details and click calculate to view your estimate.

How this is calculated

Workers’ Compensation typically provides wage replacement and medical benefits. This calculator uses standard industry formulas:

- Weekly Benefit: Estimated at ~66.7% of your average weekly wage, adjusted by your disability percentage.

- Medical & Rehab: Added directly to the total as they are typically fully reimbursable.

Note: Different states have different maximum weekly caps (e.g., CA ~$1,600, TX ~$1,100). This tool uses a general formula.

Disclaimer: This calculator provides estimates only and is not a substitute for professional legal advice. Actual compensation amounts may vary based on specific circumstances, jurisdictional rules, and other factors.

Understanding your workers compensation liability is critical for budgeting and staying compliant. This WCRA Calculator helps you estimate your potential premiums and assessments quickly. Instead of waiting for a surprise bill from your insurer or the Reinsurance Association, you can get a clear baseline of your costs right now.

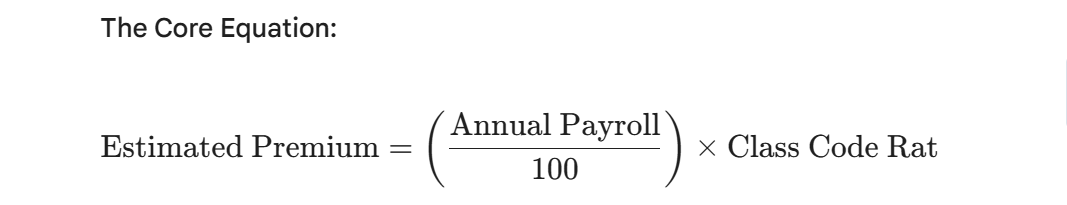

The Formula Behind Your Premium

The calculation for workers compensation premiums, which forms the basis for any WCRA (Workers Compensation Reinsurance Association) assessment, relies on a standard industry formula. It combines your labor costs with the specific risk level associated with your industry.

The fundamental equation is:

Understanding the Variables

To get an accurate result, you need to have these three pieces of data ready:

| Variable | Definition | Impact on Cost |

| Annual Payroll | The total gross wages paid to employees. | Higher payroll equals higher premiums. |

| Class Code Rate | A dollar amount assigned to a specific job type. | High-risk jobs (like roofing) have higher rates. |

| Experience Mod | A multiplier based on your claims history. | A score below 1.0 acts as a discount. |

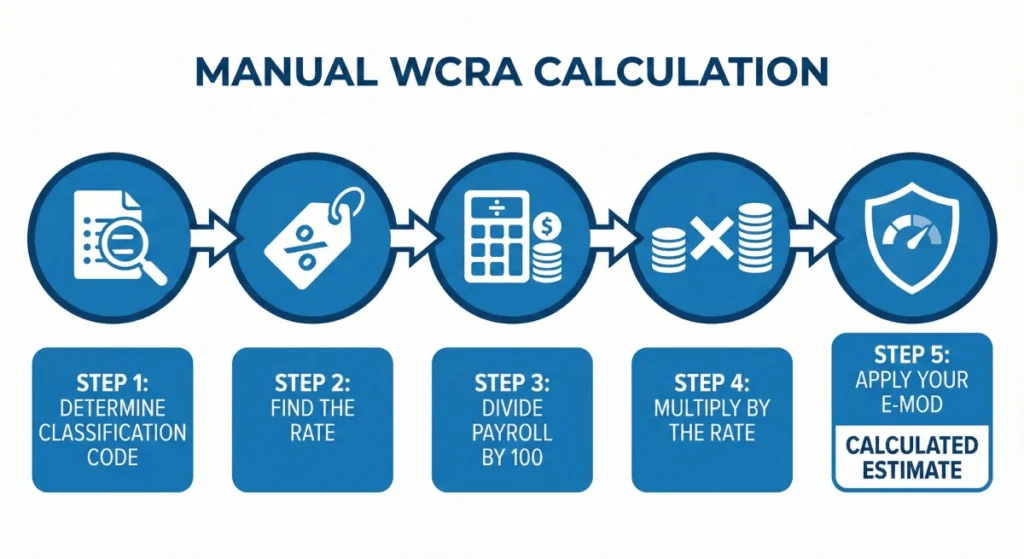

How to Calculate WCRA Costs Manually

You do not always need a digital tool to get a rough estimate. You can follow these steps to calculate your baseline premium yourself.

Step 1: Identify Your Classification Code

Find the specific NCCI (National Council on Compensation Insurance) code that matches your business activities. If your business has multiple departments, you may have several codes.

Step 2: Determine the State Rate

Look up the current rate for that class code in your specific state. Rates vary significantly depending on local regulations and industry trends.

Step 3: Calculate Your Payroll Units

Take your total annual payroll and divide it by 100. This is because rates are always quoted “per $100 of payroll.”

- Example: For a $500,000 payroll, the calculation is 500,000 / 100 = 5,000 units.

Step 4: Apply the Rate and E-Mod

Multiply your payroll units by the Class Code Rate, then multiply that total by your Experience Modification Factor (usually 1.0 for new businesses).

A Practical Calculation Example

Let’s look at a real scenario for a plumbing contractor to see how these numbers interact.

- Business Type: Plumbing Contractor

- Annual Payroll: $500,000

- Class Code Rate: $4.50

- Experience Mod: 0.9 (Good safety record)

The Math:

- Payroll Units: 500,000 / 100 = 5,000

- Base Premium: 5,000 x 4.50 = 22,500

- Final Estimate: 22,500 x 0.9 = 20,250

In this case, the business should budget approximately $20,250 for their coverage. Any specific WCRA assessments or state surcharges would typically be a small percentage added on top of this base figure.

Expert Recommendations for Lowering Your Costs

Workers compensation is a controllable cost. Here are three actionable tips to keep your premiums and assessments as low as possible.

1. Verify Your Class Codes Constantly

This is the most common error in the industry. If your office administrator is classified as a “roofer” simply because they work for a roofing company, you are overpaying by a massive margin. Ensure every employee is classified strictly by their specific daily duties.

2. Manage Your E-Mod Aggressively

Your Experience Modification factor follows you for three years. A small claim today impacts your rates for a long time. Implement a strict Return to Work program to close claims faster and keep your E-Mod below 1.0.

3. Audit Your Annual Statement

Insurance audits happen every year. When you receive your final bill or WCRA assessment, check the payroll numbers against your actual tax returns. Insurers often estimate on the higher side if they do not receive exact data from you.

A Brief History of Workers Compensation

The concept of compensating workers for injuries started in ancient Sumeria roughly 4,000 years ago. Their laws outlined specific monetary payments for the loss of body parts.

The modern system we recognize today began in Germany in 1884 under Chancellor Otto von Bismarck. It was designed as a “Grand Bargain” between labor and owners. Workers gave up their right to sue employers for negligence in exchange for guaranteed, no-fault medical and wage benefits. This model eventually spread globally and formed the basis for associations like the WCRA.

Frequently Asked Questions

What does WCRA stand for?

It typically stands for Workers’ Compensation Reinsurance Association. These organizations help insurance companies cover catastrophic claims. They often assess fees based on your standard premium.

Why is my Experience Mod (E-Mod) higher than 1.0?

An E-Mod above 1.0 means your business has reported more claims or higher claim costs than the average company in your industry. Improving safety protocols can lower this number over time.

Does overtime pay affect my calculation?

Generally, yes. However, in many states, the “premium” portion of overtime (the extra half-time pay) is excluded from the calculation. You typically only pay premiums on the straight-time portion of overtime wages.

More Helpful Tools

If you are managing your health or tracking milestones, check out our other popular calculators:

- 10,000 Days Old Calculator – Find your exact age in days and celebrate your next big milestone.

- 36 Hour Fast Calculator – Measure your progress and track the health benefits of your fasting window instantly.